WHY SHOULD YOU CONSIDER THIS?

Real Estate with Challenges

Sometimes, existing real estate incurs higher total ownership costs than the potential rental income it generates. If you're not using the property yourself, negative net returns can arise, especially in regions with limited appreciation potential. Even with older rented properties, costs, revenues, and value appreciation are not always properly balanced, leading to an incomplete assessment of the asset's true performance within the portfolio. Beneath it all, there is always land with potential for wealth-building through alternative uses. We are here to help you think through the best approach.

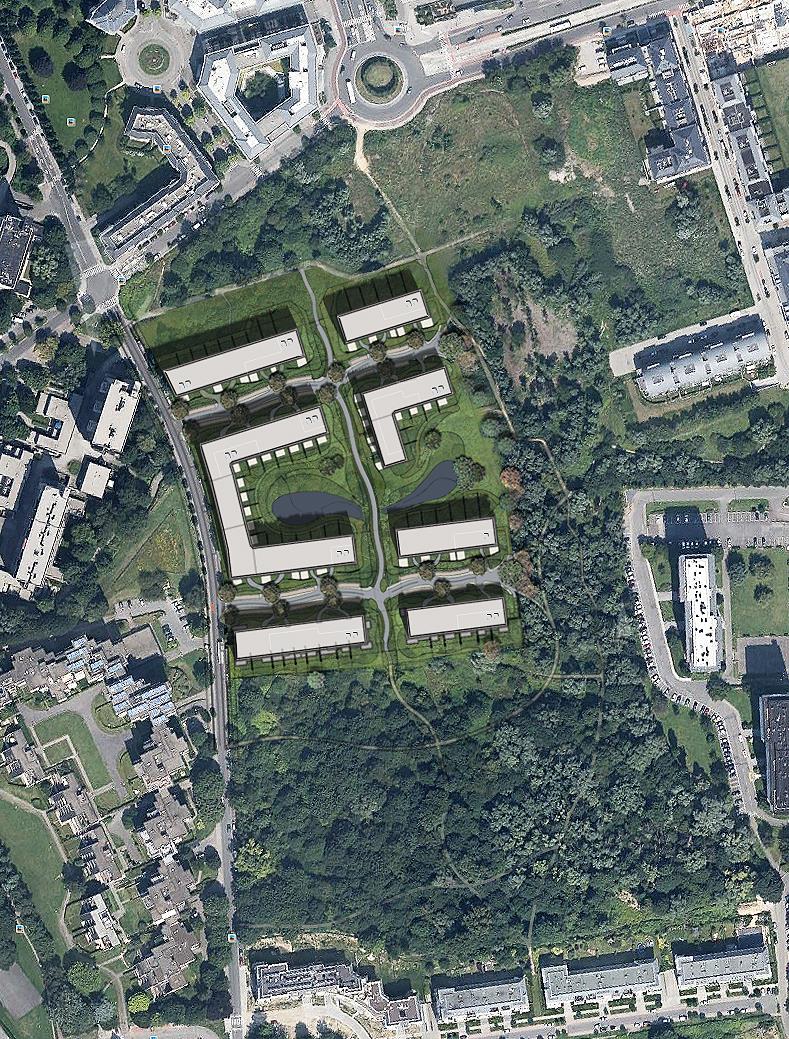

In some cases, a piece of land may appreciate in value, but it may be too early or unprofitable to initiate a project for passive income generation. Here too, we provide advice on alternatives beyond a simple sale. One example is leveraging the property as collateral in combination with other potential profitable uses, such as developing new buildings. With this capacity, you can then invest in locations with greater potential for wealth-building through real estate.

Sometimes, renovation or redevelopment turns out to be simpler than initially thought. We evaluate future rental income against financing costs, transforming an uncertain property into a profitable asset within the framework of passive wealth-building for the future. This way, we turn uncertainties into returns.